CMBS Seen As Pivotal in the Next Year as Real Estate Lending Growth Continues

Commercial-property lenders are expected to loosen restrictions imposed after the 2008 credit crisis, with a jump in financing projected for next year, a survey by PricewaterhouseCoopers LLP and the Urban Land Institute shows.

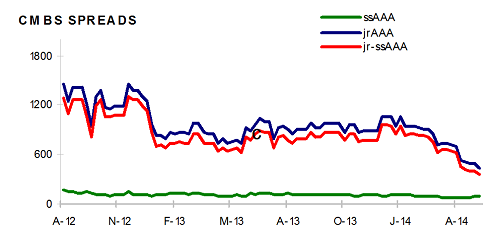

The commercial mortgage-backed securities market ranks at the top of the survey for expected change in availability, according to a report to be released today. Several respondents estimated originations may exceed $100 billion in 2014, which would be more than any period except 2005 through 2007, when the market for real estate bonds surged before rising delinquencies caused demand to crash.

Investor demand for commercial real estate should grow along with a steadily improving economy, even if interest rates climb, according to the report. The reason, in part, is a rising level of comfort among lenders, including commercial banks, insurers and private investment firms, said Mitchell Roschelle, PwC’s national real estate practice leader and co-chairman of the study, based on responses from more than 1,000 property investors and lenders.

“Some of the credit-quality concerns that people had with real estate have evaporated with time,” he said in a telephone interview from New York, where the professional-services firm is based. “We’ve worked through those problems, and the other thing is what used to be headwinds have changed to tailwinds, in many cases, in the eyes of real estate market participants.”

No Chill

The fiscal cliff, speculation over potential tapering of Federal Reserve debt purchases, the partial government shutdown and the brinkmanship over the debt limit “didn’t seem to chill the commercial real estate market,” Roschelle said. “We continued to add jobs, we’re continuing not to wildly add to supply, housing’s recovering, real estate cash flows are improving.”

Banks have arranged $63.5 billion of CMBS this year, data compiled by Bloomberg show. Issuance is poised to reach $80 billion in 2013, according to Credit Suisse Group AG.

About 43 percent of survey respondents said they expect debt-underwriting standards to be less rigorous next year, the most since PwC and the Urban Land Institute started asking the question in 2009. Last year, only 20 percent held that opinion.

About 17 percent believe lending will become more rigorous next year, down from 39 percent a year ago. The remainder told the researchers it should be about the same.